THAT FACE YOU MAKE WHEN THE GOVERNMENT PASSES A TAX ON GROSS INCOME.

Our clients have been asking about the new “Gross Income Tax” that Oregon passed this year. What is it? When does it go into effect? How much is it? Do I have to pay it? We’ve made an attempt to answer some of those questions below. Note 12/12/19: Additional information has been made available since this was originally posted. There will likely be more to come. Keep in mind that this information may already be obsolete, and that you should consult a tax professional regarding your specific situation.

The Short Version:

- Starting with tax years beginning 1/1/2020, a tax of $250 plus a tax rate of 0.57% on “Commercial Activity” exceeding $1,000,000 is imposed on individuals and business entities. The act provides that a business may deduct from “Commercial Activity” the greater of 35% of labor costs (not including compensation > $500k paid to any individual), or 35% of “Cost Inputs” as Defined by IRC 471 (ex. material purchases, freight, depreciation).

- If your “Commercial Activity” exceeds $750,000 at any point in the tax year, you will have to register with the Oregon Department of Revenue for this tax. There may be penalties up to $1,000 per calendar year for failing to file.

- Once the $1,000,000 threshold has been reached, quarterly payments of the CAT will be required.

- The annual CAT is due April 15th of the following year. This will likely be a new tax return separate from your Oregon income tax return.

- If a person decides to sell a business, close up shop, or exchange a business or stock that had generated any CAT liability, that person is required to file a CAT return and pay the tax liability within 45 days of the transaction/transfer unless specific conditions are met.

The Long Version:

According to Oregon.gov, “On May 16, 2019, Governor Kate Brown signed House Bill 3427 into law. The legislation […] adopts a new Corporate Activity Tax (CAT) imposed on all types of business entities.”

- “The corporate activity tax imposed under section 63 of this 2019 Act for each calendar year shall equal $250 plus the product of the taxpayer’s taxable commercial activity in excess of $1 million for the calendar year multiplied by 0.57 percent (state.or.us, pg. 35-36).”

- HB 3427 page 29 defines “Commercial Activity” as follows: “Commercial Activity” means the total amount realized by a person, arising from transactions and activity in the regular course of the person’s trade or business, without deduction for expenses incurred by the trade or business (state.or.us).

- HB 3427 page 33 also Defines a “Person” as follows: “Person” includes individuals, combinations of individuals of any form, receivers, assignees, trustees in bankruptcy, firms, companies, joint-stock companies, business trusts, estates, partnerships, limited liability partnerships, limited liability companies, associations, joint ventures, clubs, societies, entities organized as for-profit corporations under ORS chapter 60, C corporations, S corporations, qualified subchapter S subsidiaries, qualified subchapter S trusts, trusts, entities that are disregarded for federal income tax purposes and any other entities.] (state.or.us).”

“Commercial Activity” and “Taxable Commercial Activity” are NOT the same as Gross Income. Gross Income is equal to Net Sales less Cost of Good Sold. “Commercial Activity” as it is currently understood is Gross Income less the greater of 35% of labor costs (not including compensation > $500k paid to any individual), or 35% of “Cost Inputs” as Defined by IRC 471 (ex. material purchases, freight, depreciation).

If your annual “Taxable Commercial Activity” didn’t exceed the $1,000,000 threshold, you are exempt from this tax for the year. Don’t forget the registration requirement for exceeding the $750,000 threshold though. More on that later.

“Commercial Activity” for many of our clients will be very similar to their true “Gross Income.” However, there are 43 items specified as not “Commercial Activity” which may play a role in your specific situation. These items can be found on pages 29-31 HB 3427 linked at the end of this post. A few of those exceptions that may be of interest to our clients include:

- (A) Interest income except interest on credit sales;

- (B) Receipts from the sale, exchange or other disposition of an asset described in section1221 or 1231 of the Internal Revenue Code, without regard to the length of time the person held the asset;

- (C) Proceeds received attributable to the repayment, maturity or redemption of the principal of a loan, bond, mutual fund, certificate of deposit or marketable instrument;

- (D) The principal amount received under a repurchase agreement or on account of any transaction properly characterized as a loan to the person;

- (N) Receipts from the sale, transfer, exchange or other disposition of motor vehicle fuel or any other product used for the propulsion of motor vehicles [Note: This means: Motor vehicle fuel as defined in ORS 319.010; and fuel the use of which in a motor vehicle is subject to taxation under ORS 319.530.];

- (U) In the case of amounts retained as commissions by a holder of a license under ORS chapter 462, an amount equal to the amounts specified under ORS chapter 462 that must be paid to or collected by the Department of Revenue as a tax and the amounts specified under ORS chapter 462 to be used as purse money;

- (W) Dividends received;

- (X) Distributive income received from a pass-through entity;

- (Y) Receipts from sales to a wholesaler in this state, if the seller receives certification at the time of sale from the wholesaler that the wholesaler will sell the purchased property outside this state [Note: “Wholesaler” means a person primarily doing business by merchant distribution of tangible personal property to retailers or to other wholesalers.];

- (AA) Receipts from the wholesale or retail sale of groceries [Note: “Groceries” means food as defined in 7 U.S.C. 2012(k).];

- (EE) Surcharges collected under ORS 757.736;

The $1,000,000 threshold isn’t the only mark we need to pay attention to. The registration requirement for CAT occurs a lower Gross Income amount as detailed on pages 36-37 of HB 3427:

- (1) Any person or unitary group with commercial activity in excess of $750,000 in the tax year shall register with the Department of Revenue.

- (2) The department by rule may establish the information pertaining to the person or unitary group that must be submitted to the department accompanying the registration and the time and manner for issuance of registrations under this section.

- (3) The department may impose a penalty for failing to register as required under this section, not to exceed $100 per month that a person or unitary group has failed to register or a total of $1,000 in a calendar year. The penalty under this subsection may be imposed not earlier than 30 days after the date on which the commercial activity of the person or unitary group exceeds $750,000 for the tax year.

In addition to these stipulations, if you decide that you want to sell you business, or that you need to close up shop for any reason, keep the following in mind:

- “If any person quits business or sells out, exchanges or otherwise disposes of a business or stock of goods, any corporate activity tax imposed under section 63 of this 2019 Act shall become immediately due and payable. The person shall, within 45 days after the sale, exchange or disposition, make a return and pay the tax due (state.or.us, pg. 37).”

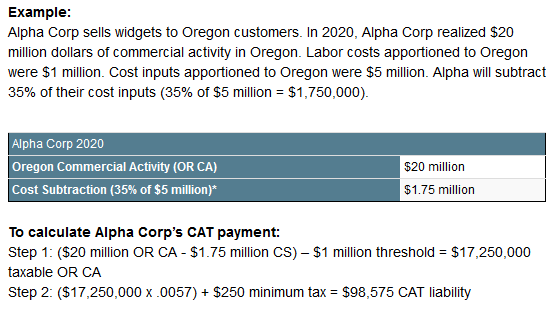

Example:

In order to illustrate the effect of this new law we’ve included the example presented on the oregon.gov website:

Its important to note that even if Alpha Corp had a net loss of $1,000,000 this year, they still have to pay the Oregon Department of Revenue $98,575.00 for the “privilege of doing business in this state (oregon.gov).”

Hopefully, situations like this will be exceedingly rare. We suspect that the majority of the cost imposed on taxpayers will be the result of the administrative burden that this tax creates.

The information we’ve included here is by no means exhaustive and is not intended to be tax advice for you or your organization. You should consult a professional regarding your specific situation. Give us a call or schedule an appointment. We are here to help.

Sincerely, Robert D. Russell, CPA PC

Resources:

https://www.oregon.gov/DOR/programs/businesses/Pages/corporate-activity-tax.aspx

https://olis.leg.state.or.us/liz/2019R1/Downloads/MeasureDocument/HB3427